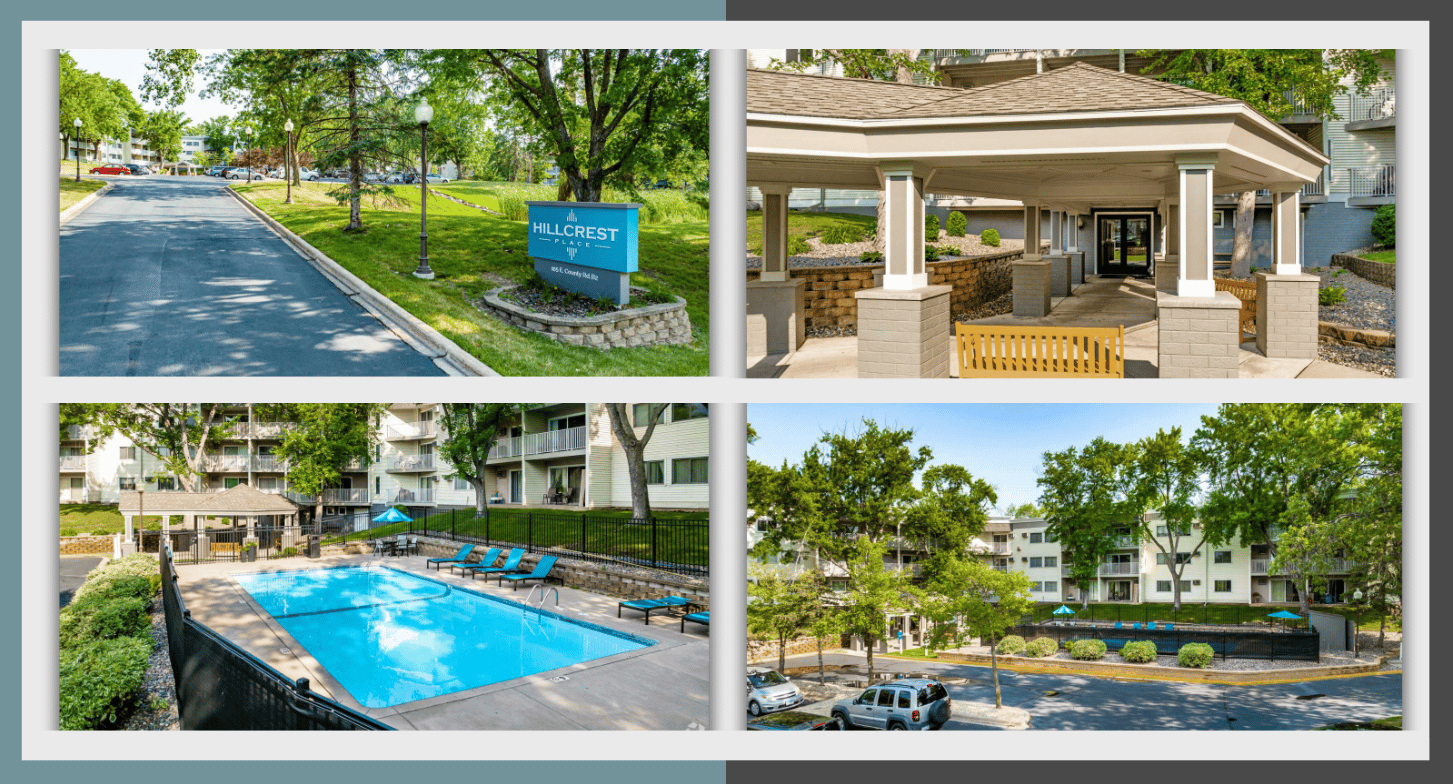

Last week, I shared that the subscription period for Hillcrest Place Apartments (111 units in Little Canada, MN) is now open, along with the full slide deck and access to the investor portal.

In this follow-up, I want to focus on one of the key reasons many investors are looking at Hillcrest before year-end: accelerated depreciation and the return of 100% bonus depreciation. For real estate professionals, this allows you to reduce your taxable income

The last time we had 100% bonus depreciation was in 2022, and the impact for our investors was significant. For a real-world example, in the Riverway Apartments investment, a $100,000 investor received the following depreciation allocations:

2022 Tax Year: –$47,000

2023 Tax Year: –$10,000

2024 Tax Year: –$5,300

That’s more than $62,000 of total depreciation in the first three years—over 60% of their original investment sheltered and $62,000 in income that the investor did not have to pay taxes on.

While individual outcomes will vary depending on the final cost seg results and your personal tax situation, the goal is the same: Front-load depreciation to help offset passive income and improve after-tax returns.

Please consult with your CPA or tax advisor to understand how depreciation may apply to your individual situation.

Join Us for the Hillcrest Apartments Webinar

This week, I’d like to invite you to a live investor webinar where we’ll walk through the Hillcrest Place business plan, projected returns, and the impact of 100% bonus depreciation — and answer your questions in real time.

📍 When: This Thursday at 7:00 PM CST

🎥 Format: 30–40 minute presentation + live Q&A

Investment Overview

111 units in a strong Twin Cities suburb - Little Canada, MN

Discounted basis relative to values over the past 5 years

Renovation upside, with renovated units currently achieving a $180/month premium over original units

Supply pipeline slowdown, with fewer new apartments being delivered across the metro

Steady 3% rent growth historically in the Twin Cities suburbs

Investment Snapshot

Capital Raise: $5,570,000

Minimum Investment: $50,000 (Cash & Solo 401k funds acceptable)

Estimated Closing: December 16, 2025

Depreciation: Bonus depreciation projected for the 2025 tax year

Click Access Investor Portal to reserve your allocation today.

Please reach out with any questions.

Ben Michel

[email protected]

ridgeviewpropertygroup.com

This 506(c) offering is open to accredited investors only. The numbers presented are projections; actual numbers are dependent on asset performance.