"The city shouldn't be giving money to developers!"

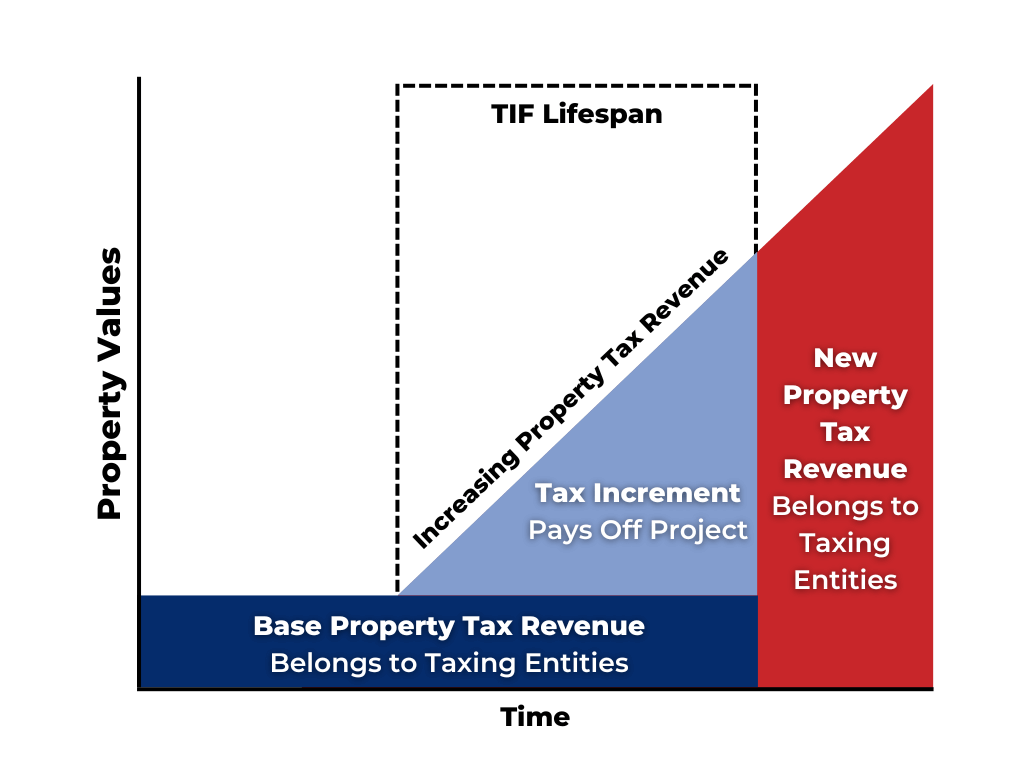

It’s a common argument from those opposing a development project. Often in these cases, the developer is requesting Tax Increment Financing (TIF) to help fund a project. Based on their statement, it's evident that the opposition doesn’t understand TIF!

Tax Increment Financing is a clever tool for helping pay for new infrastructure at little or no cost to the city. In this week’s Ridgeview Report, we’ll explain how it works using our very own Pineview Townhomes as a case study.

Requesting TIF

Back in 2018, the city of Jordan, MN, hadn’t had any rental housing development for 5+ years. A local developer approached the city and requested TIF to build a 28-unit townhome complex.

The city approved $266K in TIF for the development, plus added a few stipulations. In return for the TIF, the developer will keep 20% of the units income-restricted for the life of the TIF. Also, the developer will build a playground and a basketball court next to the property. These amenities will be dedicated to the city.

Fulfilling their agreement with the city, the developer built the 28-unit townhome complex, complete with the playground and basketball court. The project was completed in 2019.

The developer decided to sell the property shortly after completion. Ridgeview Property Group purchased both the complex and the TIF note in July 2021. Since Ridgeview assumed the original development agreement with the city, all stipulations must still be followed, including keeping 20% of the units income-restricted.

From property tax revenue comes TIF payments

Over the last 3 years, the city has paid out ~$60K per year in TIF payments on average. These payments do not originate from the city of Jordan’s coffers, however. Since the complex was built, the property tax revenue has ballooned from $8K to $80K, and it's from this $72K revenue increase that the city can fund those payments.

The Endgame

Once the $266K TIF note has been fully paid off, the city will no longer make TIF payments to Ridgeview. They will now receive $80K+ in property tax revenue in perpetuity! In addition, the city of Jordan has added a new public playground and basketball court and, most importantly, 28 units added to its housing stock.

Ben Michel - Principal

Ridgeview Property Group

Market News

Tides hit with two more DFW foreclosures

Two of the Los Angeles-based firm’s Dallas properties are slated to be sold at a foreclosure auction on Tuesday, according to Roddy’s Foreclosure Listing Service. That makes five DFW multifamily properties owned by the firm that have faced foreclosure or returned to lenders.

Tides became one of the biggest multifamily players in Texas, snapping up nearly 15,000 multifamily units in the Lone Star State when interest rates were low. But the firm struggled to pay off debt after rates ballooned its debt service.

RE Journal (2024, July 1). "Tides hit with two more DFW foreclosures”https://therealdeal.com/texas/dallas/2024/07/01/tides-equities-faces-foreclosure-on-two-dallas-properties/

Tips & Tricks

Terms:

Income Restricted: Income-restricted apartments are rented units limited to tenants earning below certain total household income thresholds. To ensure that the property owner stays in compliance, annual verification of tenant incomes is typical.

Development Agreement: A legally binding contract between a property owner or developer and a local government, often including terms not otherwise required through existing regulations.

Housing Stock: The total number of houses and apartments in an area or region.

Thank you for reading and your interest in Ridgeview Property Group. If you want to read more newsletters like this, click “Subscribe to The Ridgeview Report”.

To invest alongside us, click “Invest With Us” to sign up for the Ridgeview investor portal.