The best deals often have poor property management. It is the lackluster management that opens the door for so much upside potential in the first place. Underwriting these properties is more challenging than the typical deal, however. The income and expenses from the Trailing 12 profit and loss may be too unreliable to work off:

Laundry income might be zero since the building owner collects the coins and doesn’t record the income.

Administrative and Payroll expenses could be light when the owner self manages.

The water bill could be high due to poorly maintained toilets.

So how does one accurately estimate these income and expense categories? An audit of each line item in the historical financials is needed to project how the property will perform. After all, mistakes in these assessments could lead to wildly overvaluing a property. This week’s newsletter breaks down how to deal with this issue.

Step 1: Underwrite a ton of deals

Sophisticated investors are underwriting a high volume of deals. Just about every professionally managed property in my market, no matter how large, is worth underwriting. The objective is to gather accurate income and expense data and also refine my understanding of standard financial expectations.

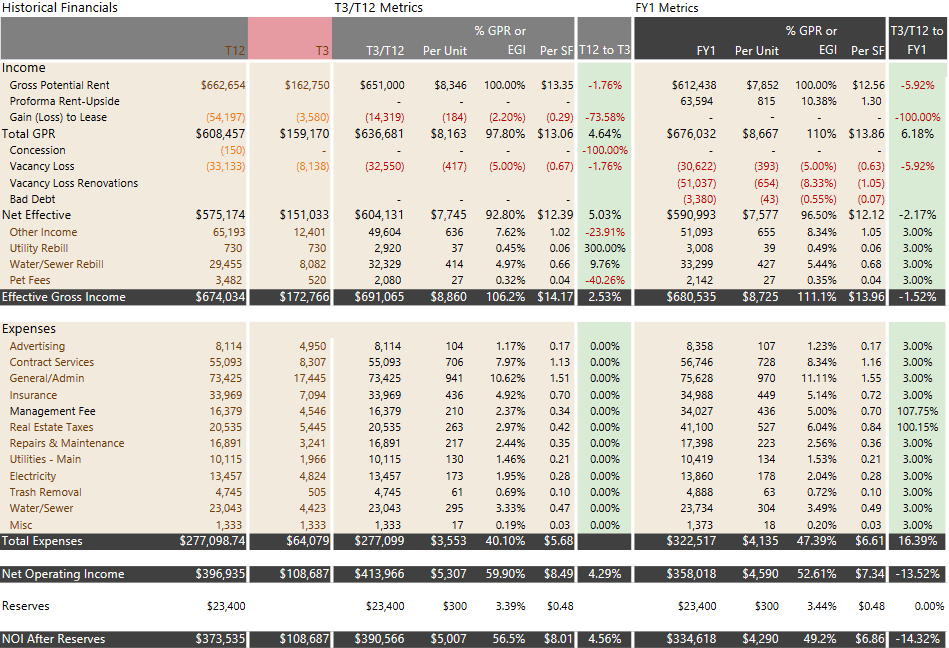

Every property manager uses different income and expense categories on their P&Ls, and a key compenent to underwriting is reorganizing the data into standardized categories. An example would be how I prefer to separate Repairs & Maintenance from Turnover costs, and some property managers bundle them together. The income and expense data for one property can’t be compared with that of another unless each category is apples to apples.

Step 2: Build and maintain a database

After underwriting countless deals, I now have a trove of income and expense data in my market. The next step is to create a comprehensive database. I compile all my data on Airtable.

On every deal, I copy the income and expense metrics from my underwriting and paste them into Airtable. (To facilitate this, I added a dedicated page to my underwriting spreadsheet for exporting data.) By compiling every possible income and expense category on a per-unit basis, I now have a wealth of data to help me underwrite future deals.

Step 3: Reference the database

Once I have collected and organized the data, it's time to use it. When I need to know where an income or expense should generally be, I consult my database of similar properties.

Let’s say I have unreliable Repair and Maintenance (R&M) data at the property I’m underwriting. First, I filtered the properties to those of similar vintage within the same market. I then used the average of the data points for the R&M expense, omitting any outliers:

Using the above table, I’ve identified 8 similar properties to reference their income and expense data. The sample group has R&M expenses that vary from $349 to $888/unit and an average of $575/unit. $575 gives me a good idea of where R&M should come in on a comparable property. To be conservative, I might round it up to $600 or $625 per unit.

Predicting income and expenses is not a perfect science, so I err on the side of caution. Just because all the neighboring properties have a gas bill that is 40% lower per unit, doesn’t mean I can expect similar on my property. After all, the property and its boiler could have an underlying issue that needs to be addressed first.

Step 4: Rinse and repeat

I verify every income and expense in this way while I’m building a proforma P&L. My goal is to end up with projections that are as realistic as possible based on the performance of other properties nearby. My offer on a property is highly dependent on my proforma, so it’s important to get this right.

Final thoughts

Accurately estimating income and expenses is challenging when dealing with unreliable financial records. By underwriting a large number of deals and organizing that data into a database, investors can refine their understanding of market norms and standard financial expectations. This approach allows for informed decision-making when assessing income and expense items, ensuring that the proforma P&L is grounded in reliable data rather than assumptions.

Ben Michel - Principal

Ridgeview Property Group

Market News

Multifamily Trends and Market Outlook

A Forbes article provides an overview of commercial real estate investment, focusing on the multifamily sector. It highlights unique benefits such as diversification, tax advantages, and an effective hedge against inflation. Representing 70% of the $5.4 trillion U.S. CRE market, the multifamily sector is noted for its stability, consistent cash flow, and resilience against market volatility.

Forbes (2024, May 7th). "Maximizing Returns: Strategies For Multifamily Real Estate.”https://www.forbes.com/sites/forbesbusinesscouncil/2024/05/07/maximizing-returns-strategies-for-multifamily-real-estate/

Tips & Tricks

Terms:

T12: The T12 (Trailing 12-month) profit and loss statement summarizes a business's financial data over the previous 12 months. It includes all sources of income and expenses and provides an overview of revenue, expenses, profits, and losses. This document helps identify areas where businesses can reduce overheads or boost sales growth potential and can aid in decision-making about investment opportunities and increasing value.

Thank you for reading and your interest in Ridgeview Property Group. If you want to read more newsletters like this, click “Subscribe to The Ridgeview Report”.

To invest alongside us, click “Invest With Us” to sign up for the Ridgeview investor portal.